39+ california mortgage interest deduction

Web If youve closed on a mortgage on or after Jan. For tax year 2022 those amounts are rising to.

Changes To California Mortgage Interest Deduction Limit In 2018

Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly.

. Web While the full details are in IRS publication 936 httpswwwirsgovpublicationsp936 the gist is that only the mortgage interest on the. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Find A Lender That Offers Great Service. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. California has around 40 million.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

Web California Rules For Mortgage Interest Deduction. Web Even the Trump administration thought that the MID cap was excessive and capped the federal deduction at 750000 per home. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web 7 hours agoA Riverside tax preparer pleaded guilty today to federal criminal charges for filing thousands of tax returns that falsely claimed deductions such as fake medical. In the state of California they use the same value that is on an individuals federal tax return. However higher limitations 1 million 500000 if married.

Homeowners who bought houses before. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Compare More Than Just Rates.

Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Federal changes limited the mortgage interest deduction debt maximum from 1000000 500000 for.

Web According to the Tax Cuts and Jobs Act of 2017 taxpayers may deduct up to 750000 in home loan interest for homes purchased as of December 16th 2017. Web California does not permit a deduction for foreign income taxes. Web Most homeowners can deduct all of their mortgage interest.

Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

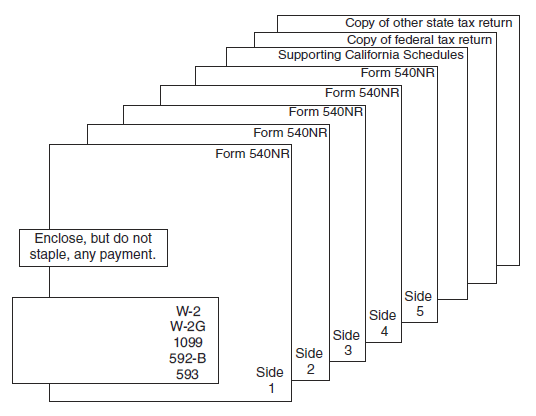

2020 540nr Booklet Ftb Ca Gov

Mortgage Interest Deduction Changes In 2018

Coming Home To Tax Benefits Windermere Real Estate

Itemized Deductions For California Taxes What You Need To Know

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction Changes In 2018

The Tcja S Cap On Mortgage Interest Deductions Tells Us That Taxes Matter Up To A Point Tax Policy Center

Crc Def14a 20190508 Htm

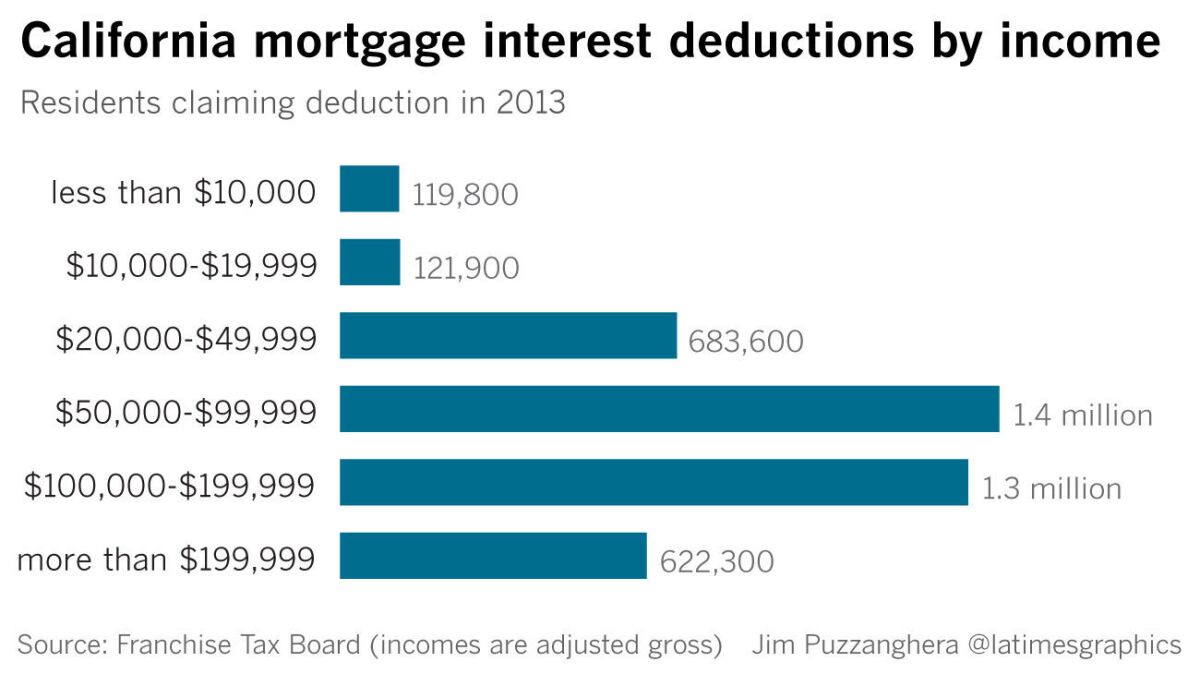

If Gop Scales Back The Mortgage Interest Deduction Californians Would Be Hit Hardest Los Angeles Times

Gutting The Mortgage Interest Deduction Tax Policy Center

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet